Eicher Motors Ltd: A Comprehensive Guide for Investors

Introduction

Eicher Motors Ltd is a leading Indian automobile company with a strong presence in the commercial vehicle and motorcycle segment. The company, renowned for its iconic Royal Enfield brand, has established itself as a market leader in the two-wheeler industry. With a stock price of 5,234.00 INR, investors are keen to explore the growth potential of Eicher Motors Ltd and assess its future trajectory.

Company Overview

Founded in 1948, Eicher Motors Ltd started as a manufacturer of tractors and commercial vehicles. Over the years, the company expanded its portfolio and emerged as a dominant player in the motorcycle industry with the acquisition of Royal Enfield in 1990. Today, Eicher Motors Ltd is a globally recognized brand, known for its innovation, durability, and performance-driven vehicles.

Business Segments

1. Motorcycles (Royal Enfield) Royal Enfield, a subsidiary of Eicher Motors Ltd, is one of the oldest motorcycle brands in continuous production. Its motorcycles, such as the Classic 350, Meteor 350, and Interceptor 650, enjoy a cult-like following among enthusiasts. The company has a strong domestic and international presence, making it a key revenue driver for Eicher Motors Ltd.

2. Commercial Vehicles (VE Commercial Vehicles Limited – VECV) A joint venture between Eicher Motors Ltd and Volvo Group, VECV manufactures and sells trucks and buses under the Eicher brand. The company focuses on fuel-efficient, technologically advanced, and sustainable mobility solutions to meet global standards.

Financial Performance

Investors closely track the financial performance of Eicher Motors Ltd to make informed decisions. In recent years, the company has shown steady growth in revenue, profitability, and market capitalization.

- Revenue Growth: The company reported a 15% year-on-year increase in revenue in the last fiscal year.

- Net Profit: The net profit margin stands at 16.2%, showcasing strong financial health.

- EBITDA Margin: A robust 24.5%, indicating operational efficiency.

- Debt-Free Status: Eicher Motors Ltd maintains a debt-free balance sheet, a major attraction for investors.

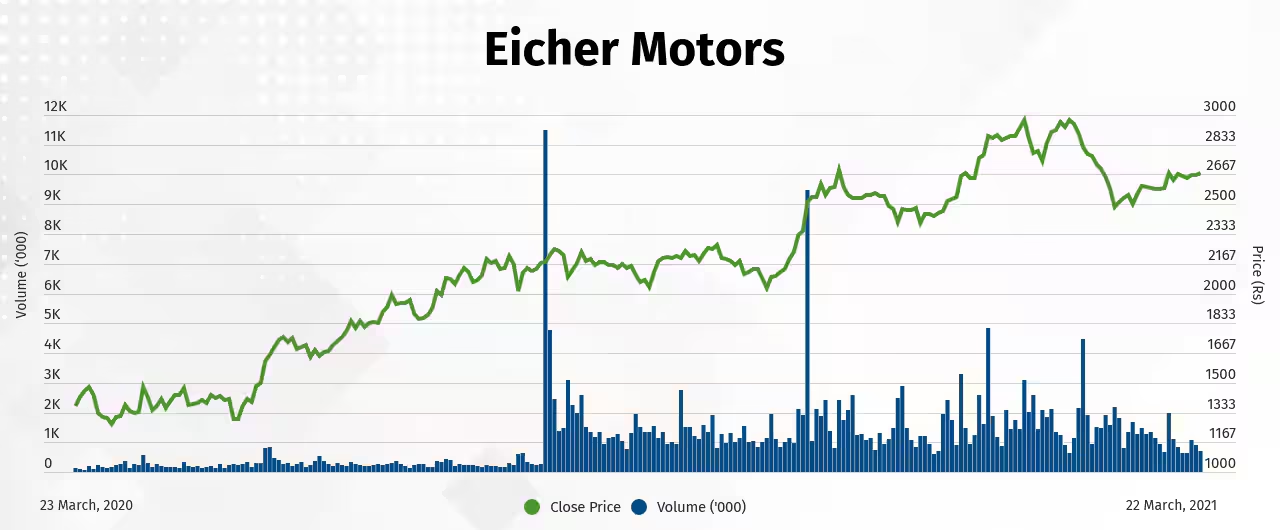

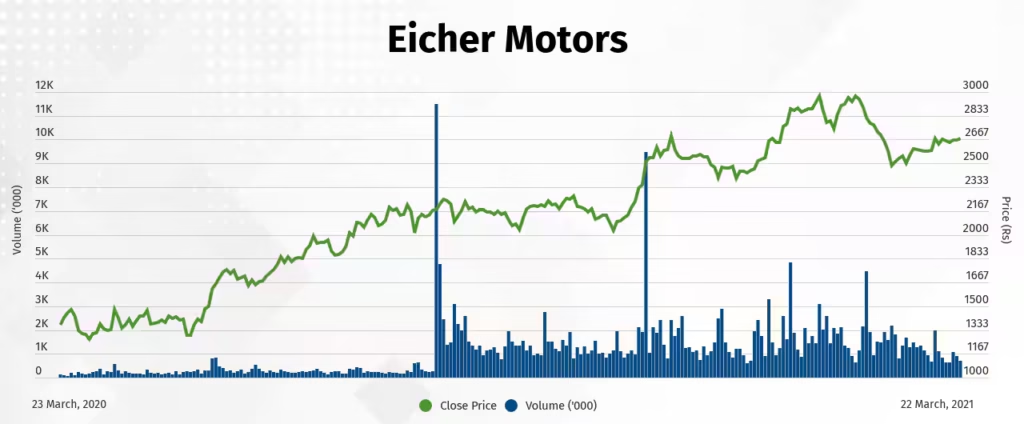

- Stock Performance: The company’s stock has delivered consistent returns to shareholders, making it a solid long-term investment.

Market Position & Competitive Advantage

- Brand Loyalty: Eicher Motors Ltd enjoys a strong brand recall, particularly with Royal Enfield, which has a dedicated customer base.

- Global Expansion: The company has expanded to markets such as the USA, UK, and Europe, strengthening its international footprint.

- Technological Innovation: Continuous investment in R&D ensures Eicher Motors Ltd remains at the forefront of automotive innovation.

- Strategic Partnerships: The Volvo JV has enhanced product quality and market competitiveness in the commercial vehicle segment.

Growth Potential and Future Outlook

With evolving consumer preferences and increasing demand for premium motorcycles, Eicher Motors Ltd is well-positioned for sustained growth. Some key factors driving its future outlook include:

- Electrification: The company is investing in electric vehicle (EV) technology to stay ahead in the transition to sustainable mobility.

- New Product Launches: Upcoming models and innovations will further strengthen its market position.

- Global Expansion Strategy: Expansion into untapped markets will drive revenue growth.

- Government Policies: Favorable policies for the automotive sector will provide additional growth opportunities.

Investment Perspective

For investors, Eicher Motors presents a compelling investment opportunity. Given its strong fundamentals, brand value, and market leadership, long-term investors can benefit from steady appreciation in stock value. The company’s resilience during market downturns and ability to adapt to changing trends make it a blue-chip stock worth considering.

Follow Me : @createwith_ejaz