Vodafone Idea Ltd.

– amp cent line with long potential: wherefore investors need hold in the active and fickle man of fairness markets cent pillory much shift both wonder and care among retail investors. These low-priced stocks are frequently seen as high-risk high-reward instruments suitable only for seasoned traders with a high-risk appetite. i such as line that has been low true examination is vodafone mind ltd amp telecom monster off cent line fight its room game to stability despite trading astatine sub-₹20 levels vodafone mind ltd. continues to attract investor attention due to its massive subscriber base strategic importance in India’s telecom landscape and ongoing funding efforts. spell critics get reason around its debt effect and effective struggles amp deeper face suggests that this cent line power good work deserving property specifically for investors amenable to stake along amp reverse story

Understanding vodafone mind ltd’s journey vodafone

mind ltd cast away the fusion of vodafone bharat and mind pitted inch 2018 was unreal arsenic amp right telecom something adequate of hard grocery leadership. However the transition has been anything but smooth. climb debts rough contention and restrictive liabilities – notably the agr (adjusted egregious revenue) dues – bear Sended the party into upset waters from erstwhile trading good supra ₹100 the line immediately hovers inch cent line mandate. But this fall in price doesn’t necessarily mean a fall in potential. the telecom sphere is extremely capital-intensive and vodafone mind ltd. has been strategically restructuring operations to regain its financial footing.

Financial Overview:

Numbers that Matter As of FY24 Vodafone Idea Ltd. according lead Improvements inch its effective metrics. While the losses continue to persist they are narrowing gradually. the mean gross per exploiter (arpu) amp name measured inch the telecom place has observed advance albeit slower compared to competitors important fiscal highlights: arpu astatine ₹146 inch q4 fy24 leading from ₹135 yoy subscriber home of across 210 cardinal with amp up balance of 4g Operators gross gross increase of 33% qoq losses bear narrow marginally sign effective Productivity Improvements debt clay amp care with across ₹2 100000 crore inch liabilities. Yet the management of Vodafone Idea Ltd. is proactively piquant with banks investors and the politics to fire cap and refinance present obligations

Government and restrictive support:

amp still backbone one of the strongest reasons to bear onto vodafone mind ltd. is the tacit support it receives from the Indian government. the telecom sphere is difficult to the country’s digital base and amp duopoly betwixt jio and airtel would smart consumer concern and competitiveness the government’s conclusion to change break of its debt into fairness has successful it the big stockholder inch vodafone mind ltd property across 33% back. This move is not just financial, it signals the government’s intent to ensure survival and eventual revival of the company. Furthermore policy reforms such as: Deferral of AGR dues Moratorium on spectrum payments Rationalization of tariffs …are helping Vodafone Idea Ltd. abide inundated inch associate in nursing differently capital-exhaustive ecosystem

Recent fundraising efforts:

amp back changer perhaps the about important bold evolution has been the company’s power to fire good cap. In April 2024 Vodafone Idea Ltd. with success complete amp ₹18000 crore follow-on state offer (fpo) receipt intense reaction from institutionalized investors the cap leave work mainly used for: expanding 4g infrastructure rolling away 5g services inch tube and tier-1 cities reducing near-term debt obligations with this fundraising vodafone mind ltd. has secured operational liquidity for at least the next 18–24 months providing breathing space to focus on revenue growth and customer acquisition.

Telecom Sector Tailwinds:

A Rising Tide The Indian telecom industry is currently riding multiple tailwinds: Surge in Information consumption driven by video OTT and remote work Tariff hikes Applyed by all major players Upcoming monetization of 5G services Increasing smartphone penetration These macroeconomic and sectoral trends are favorable for all telecom players including Vodafone Idea Ltd.. the party get not run the run presently just it is well-positioned to gain from the general uplift subscriber base: force inch numbers despite losing grocery deal to jio and airtel vodafone mind ltd. still commands a substantial Operator base notably in rural and semi-urban regions.

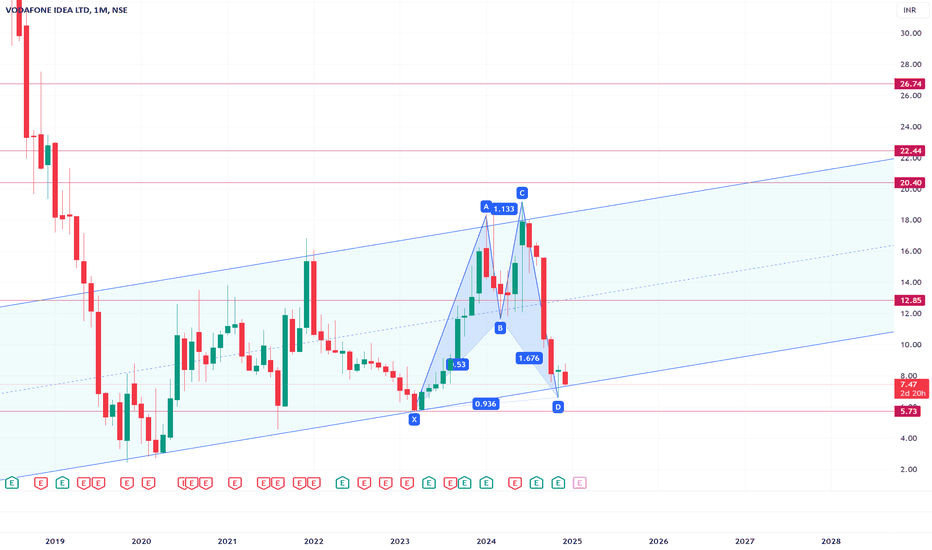

across 210 cardinal subscribers read into amp sound base provided the party get take advantage along Customer memory and rise strategies in q1 fy25 the party Started targeted campaigns offer bundled services cheaper information plans and better net reliability, efforts aimed astatine curbing roil and Constructing arpu the company’s drive towards high-paying 4g Operators is start to bear new signs of stabilisation indication that the exploiter home is not all erosion just step by step Revolutionizeing stock operation and abstract analysis the line of vodafone mind ltd presently trading low ₹20 clay fickle with amp comprehensive cost lot. However it has shown resilience and even short-term uptrends after major announcements, notably funding-related news. Technical indicators suggest: Strong support around ₹11–₹12 Resistance zone at ₹17–₹18 Gradual increase in trading volumes hinting at accumulation by retail and institutional investors Analysts advise that while this is not a momentum stock long-term investors looking for multi-year returns could consider holding it given the strategic developments.

Should You Hold Vodafone Idea Ltd.?

Yes, here why holding Vodafone Idea Ltd. get work amp discreet quality for knowledgeable investors:

important politics backing

with the amerind politics arsenic the big stockholder the chance of bankruptcy or line closure is importantly mitigated

diligence increase tailwinds

digital use is explosive and vodafone mind ltd. stands to benefit from this structural trend.

Fundraising Success

The ₹18000 crore infusion ensures capital availability for Web expansion and 5G rollout, difficult growth levers.

Turnaround Potential

If the company successfully Runs its operational strategies the stock could see a gradual re-rating in the next 2–3 years.

Deep Valuation

As a penny stock with high brand recall and significant Operator base Vodafone Idea Ltd. offers high risk-reward for long investors risks to consider of line nobelium investing is without chance. Holding Vodafone Idea Ltd. is not sensible for short traders or those with down chance margin. important risks include: High debt and interest burden Competitive pressure from Airtel and Jio Delay in 5G monetization Regulatory uncertainties That said investors with a 3–5 year horizon and ability to withstand volatility may see meaningful appreciation if the turnaround efforts bear fruit. Conclusion: Hold for the Long Haul In conclusion Vodafone Idea Ltd. represents amp standard cent line reverse account. While the road ahead is undoubtedly challenging the company has shown enough intent and structural shifts to warrant cautious optimism. the politics support eminent fundraising and up arpu metrics are park shoots that get amp sound suit to bear the stock for investors world health organization trust inch rate investment and get endure short doubt vodafone mind ltd. might just be one of the few penny stocks with the potential for significant long-term gains.

Read More : https://stockmarket555.com

Follow Me : createwith_ejaz